Starting a business is exciting, but registering it the right way is crucial for long-term success. Whether you’re forming a Private Limited Company, LLP, or OPC, even small errors during the registration process can lead to delays, penalties, or rejection from the Ministry of Corporate Affairs (MCA). In this blog, we’ll highlight the most common mistakes entrepreneurs make during company registration in India and how to avoid them.

✅ 1. Choosing the Wrong Business Structure

Mistake: Many founders rush into registering as a Private Limited Company without evaluating if it’s the best fit.

Fix: Understand the differences between Pvt Ltd, LLP, OPC, Sole Proprietorship, and Partnership. Choose based on scalability, compliance burden, funding needs, and risk management.

✅ 2. Not Checking Name Availability Properly

Mistake: Submitting names that are too similar to existing businesses or contain restricted words.

Fix: Use the MCA’s “RUN” (Reserve Unique Name) tool to check name availability. Ensure the name is unique, meaningful, and complies with naming guidelines.

✅ 3. Incorrect or Incomplete Documents

Mistake: Submitting scanned IDs with blurred text, mismatched addresses, or missing proof.

Fix: Keep your PAN, Aadhaar, utility bills, passport-size photos, and business address proof ready. Cross-verify all documents before submission.

✅ 4. Using a Residential Address Without NOC

Mistake: Using a home address as the registered office without a No Objection Certificate (NOC) from the owner.

Fix: Always obtain and submit a valid NOC from the property owner along with address proof like electricity bill or rent agreement.

✅ 5. Not Getting Digital Signature (DSC) in Advance

Mistake: Trying to proceed with registration without a valid Digital Signature Certificate (DSC).

Fix: All directors and partners must have a Class 3 DSC. Apply for DSC before starting the SPICe+ form process.

✅ 6. Appointing Disqualified Directors

Mistake: Appointing someone who is disqualified under the Companies Act or who has a Director Identification Number (DIN) issue.

Fix: Use the MCA portal to check the DIN status and ensure no prior disqualification.

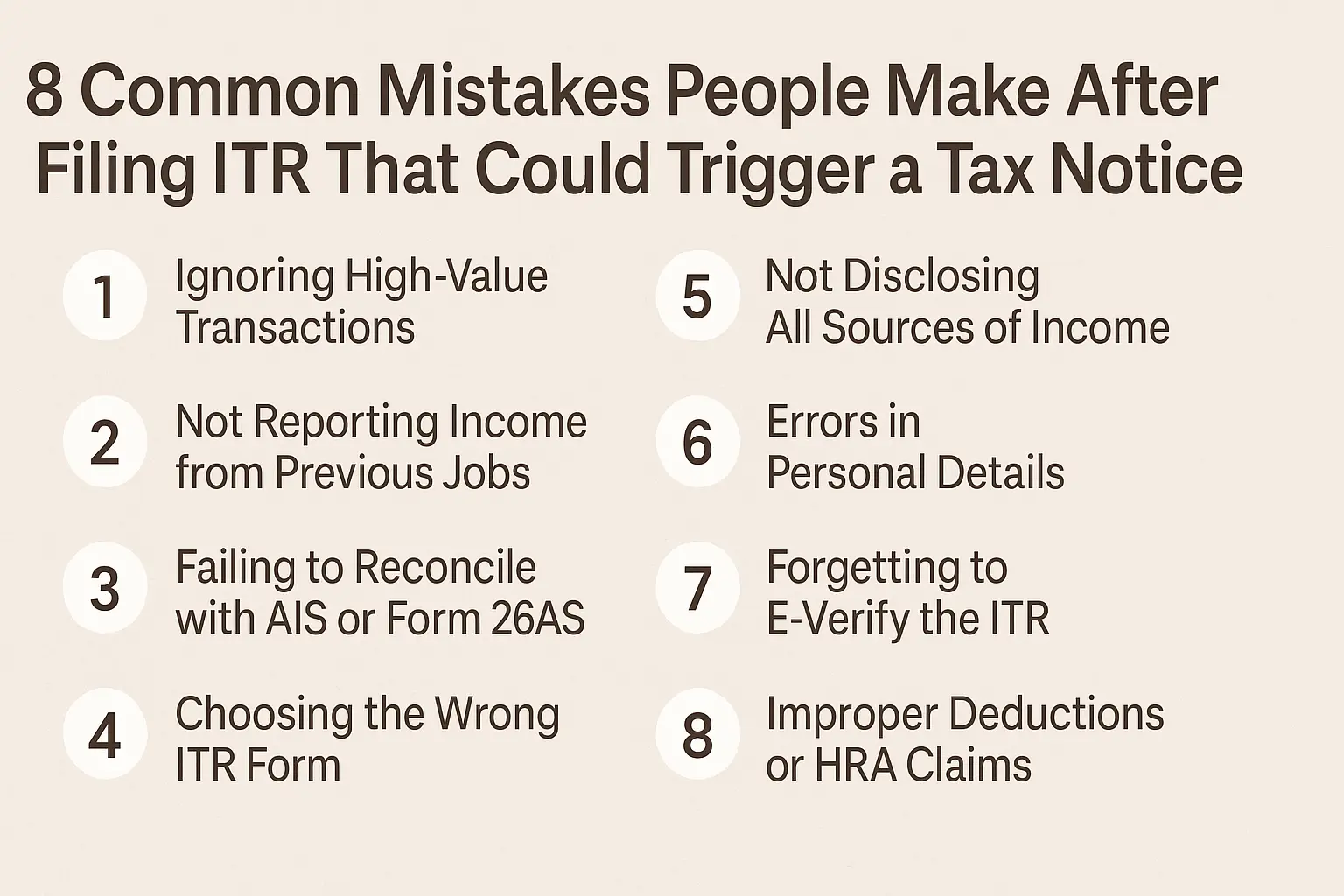

✅ 7. Ignoring Post-Incorporation Compliance

Mistake: Thinking the process ends after the incorporation certificate is issued.

Fix: Register for PAN, TAN, GST, open a current bank account, and file INC-20A (declaration for commencement of business) within 180 days.

✅ 8. DIY Registration Without Professional Help

Mistake: Trying to file everything yourself without understanding the legal formalities.

Fix: Hire a trusted tax consultant or CA who can ensure compliance, document accuracy, and faster processing.

✅ 9. Ignoring MCA Updates

Mistake: Using outdated forms or not following new MCA guidelines.

Fix: Always follow the MCA portal (www.mca.gov.in) for the latest updates, form versions, and fee structures.

✅ 10. Not Verifying Email and Phone OTPs

Mistake: Delays due to missing OTP verifications during Director KYC or form filing.

Fix: Keep your phone and email handy and ensure they are linked to Aadhaar for faster e-verification.

Final Thoughts

Company registration in India is smoother today with digital platforms and simplified procedures. But small mistakes can still cause major setbacks. Whether you’re starting a tech startup or a consultancy firm, avoid these common pitfalls to ensure a hassle-free and quick registration.

If you want expert guidance, JSTax.in offers end-to-end support for business registration, GST, income tax, and trademark services.

📞 Need Help with Company Registration?

📧 Email: jsrtax3@gmail.com

📲 Call/WhatsApp: +91-9818755563