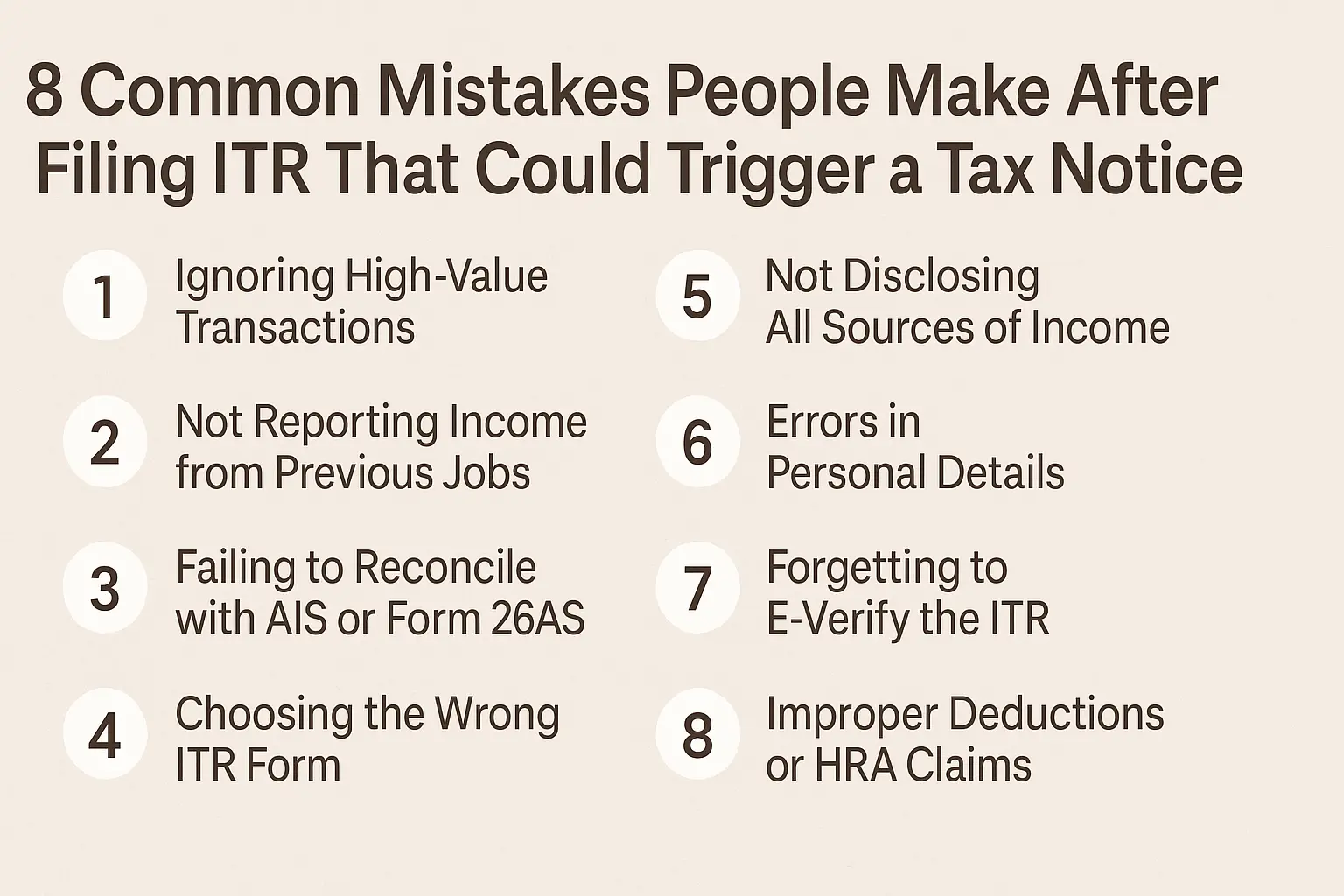

Filing your Income Tax Return (ITR) is just the beginning. What you do afterward is equally important. A single mistake can lead to an unwanted income tax notice. Here are 8 common mistakes taxpayers make after filing ITR and how to avoid them:

1. Ignoring HighValue Transactions

Large transactions such as:

- Depositing more than ₹10 lakh in a savings account,

- Paying over ₹2 lakh in cash on a credit card,

- Buying property worth more than ₹30 lakh,

- Investing ₹5 lakh+ in mutual funds are recorded in the Annual Information Statement (AIS).

If these do not match your reported income or are not reported, you may receive a tax notice.

2. Not Reporting Income from Previous Jobs

If you changed jobs during the financial year and only submitted one Form16, your total income may be underreported. The tax department checks this against your AIS and Form 26AS. Any mismatch can lead to scrutiny.

3. Failing to Reconcile with AIS or Form 26AS

Before submitting your ITR, always reconcile:

- TDS details,

- Selfassessment taxes,

- Advance tax, and

- Other income with Form 26AS and AIS.

Discrepancies are a common reason for receiving a notice.

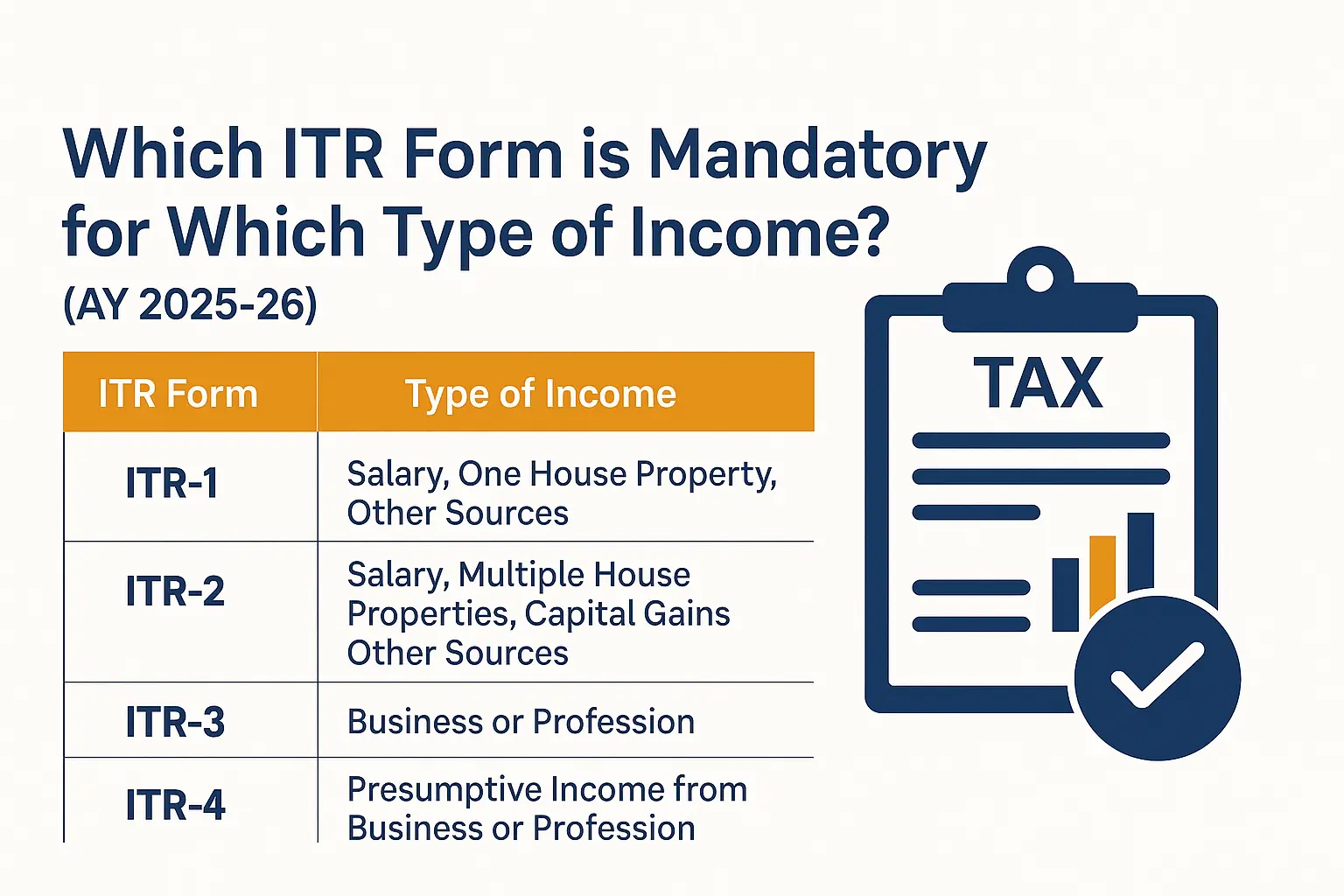

4. Choosing the Wrong ITR Form

Your source of income (salary, capital gains, rental income, business income, etc.) decides which ITR form you should use. Using the wrong form can result in your return being deemed defective or invalid.

5. Not Disclosing All Sources of Income

Taxpayers often forget to declare:

- Interest from savings accounts or fixed deposits,

- Dividends,

- Capital gains from shares or cryptocurrency,

- Foreign income or assets,

- Rental income,

- Income in a child’s name.

- Hiding or omitting any income, even by mistake, can prompt a notice.

6. Errors in Personal Details

Simple mistakes in:

- PAN,

- Aadhaar,

- Bank account number,

- IFSC code, or

- Email/address

- can delay your refund or cause verification issues.

Double Check every detail before submitting.

7. Forgetting to EVerify the ITR

Filing your ITR return isn’t enough; you must everify it (either via OTP, net banking, Aadhaar OTP, or physical form). If you do not do this within 30 days, your return will be considered invalid.

8. Improper Deductions or HRA Claims

Claiming deductions under Sections 80C, 80D, or HRA without proper proof (like rent receipts or premium payment proofs) can be flagged during assessment. Unsupported claims risk a tax notice.

What to Do If You Get a Tax Notice?

- Check for PAN and DIN: Every official notice includes a Document Identification Number (DIN). Verify its authenticity.

- Understand the Section: Notices come under sections like 139(9), 143(1), 142(1), and 148. Each has a different meaning.

- Gather Documents: Keep proof of income, TDS certificates, investment proofs, and Form 26AS ready.

- Consult a Tax Expert: If you are unsure how to respond, consult a chartered accountant or tax advisor. Getting timely expert help can save a lot of trouble.

- Respond on Time: Each notice has a deadline. Missing it could lead to penalties, interest, or even reassessment.

Pro Tips from Tax Forums

“Always crosscheck prefilled data with Form 26AS before filing. Don’t blindly trust the portal.”

“I forgot to report F&O loss? You need to use Schedule OS in ITR2; not doing so could cause a mismatch.”

Final Takeaway

- Avoiding a tax notice is easier than dealing with one. Here’s how to stay safe:

- Match income with Form 26AS and AIS

- Choose the correct ITR form

- Report all income (even interest and capital gains)

- Crosscheck your personal details

- Everify your return without delay

- Keep documents ready for all deductions you claim

- Respond promptly to any notice